BackerKit’s quest for investment and the future of crowdfunding – and how their lead investor worked for DOGE

This article first appeared on the excellent Rascal News, an “independent, reader-supported, worker-owned outlet for journalism about tabletop roleplaying games and the people who make them.” BoardGameWire is republishing it with Rascal’s kind permission – please do visit their site and check out the other exceptional reporting they’re doing!

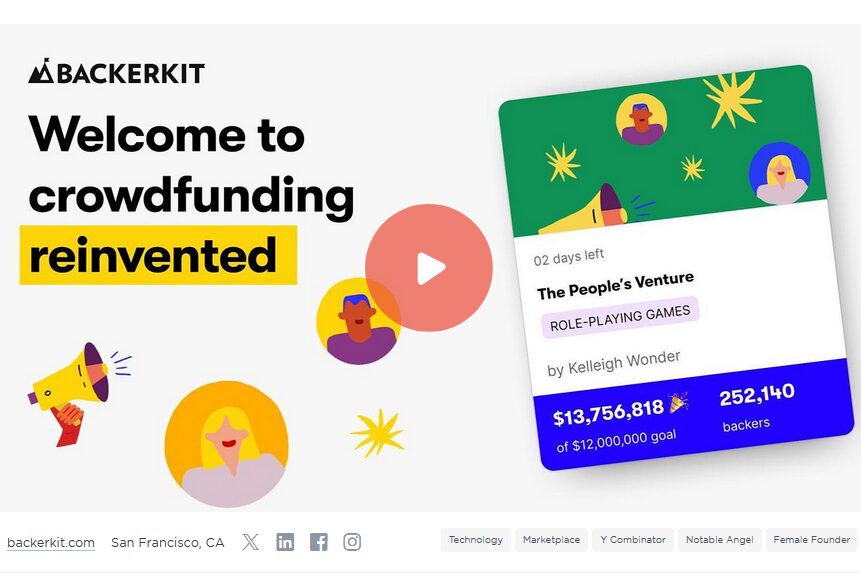

About a month ago, users of the crowdfunding platform, BackerKit, received an email about an opportunity to invest in the company. Most didn’t know what to make of it. Some thought it was a scam and moved on. But as of today, even before the ‘equity crowdfunding’ campaign becomes available to the general public, the company has already raised more than $1m from their customers – both backers as well as creators.

Maybe this should’ve been unsurprising. BackerKit’s track record is impressive: paying out more than $650m to creators, managing more than $3.7bn in pledges, and serving 15 million backers. It’s consistently built solid products, innovated with new features, and listened to customers on issues like generative AI. But the investment comes with its own complexities, risks, and small print. And the drive arrives in the midst of extreme economic uncertainty for the tabletop industry as well as widespread lack of faith in the stability of tech platforms. And then last week, we learned that one of BackerKit’s investors, Sahil Lavingia, worked for DOGE.

Let’s try and lay it all out.

BackerKit is a product of Diaspora Inc, a San Francisco-based company. The name comes from one of CEO and co-founder Maxwell Salzburg’s earlier ventures, the Diaspora social media network. Salzburg and three other fellow students at New York University started Diaspora as a decentralized alternative to platforms like Facebook. It was one of the first big crowdfunding successes, raising more than $200k on Kickstarter in 2010. The platform went open-sourced in 2013 and was handed over for a non-profit organization to run.

By this time, Salzburg and Rosanna Yau, CCO and co-founder, had already started Backerkit and caught the attention and funding of iconic venture capital firm, YCombinator. At that time, they were still primarily a pledge manager, i.e. a suite of tools to help manage existing crowdfunding campaigns. Kickstarter and similar platforms empowered creators to raise funds but were little help when it came to the shipping and distribution of rewards to potentially thousands of backers at once. Two years ago, in 2023 and after a closed beta, BackerKit launched their full-service crowdfunding product and quickly went from being a relatively invisible pillar of the entire ecosystem to one of the most visible components. “When we started, Kickstarter straight up told us: ‘creators don’t need this’”, said Salzburg. Which is relevant, as Kickstarter finally launched their own in-house pledge manager this year. “It’s actually a big stamp of validation that Kickstarter now has finally released their own thing. That’s fine. Tip of the hat… welcome to 2015.”

In the intervening decade, BackerKit has developed tools that give publishers an edge, particularly around advertising. Many of the largest RPG and board game projects (including those on other platforms) use the company’s tools for publicity and promoting their products on social media. “We resisted building it for like the first two years. Because again, we’ve always had this guiding light of: is this good for creators?” said Salzburg. “And something I will take credit for… was figuring out how to package that in a way that felt good to the tabletop community. Tech and design had been doing advertising and had really good success. But it was probably 2016 or 2017 when we started doing it – it was like the devil to tabletop in the beginning. Like, this is evil. And it is – it’s kind of a weird gnarly machine.” But tabletop publishers quickly overcame any reservations and harnessed the power of the social advertising machine, resulting in some projects achieving stratospheric results, such as MCDM’s $4m dollar campaign for Draw Steel. “It works amazing for 25% of projects… [But] it’s not like a magic button that just takes you there,” said Salzburg.

The end result is a company that has almost become ubiquitous in the tabletop space, and it seems from their equity campaign that they don’t plan to slow down. “It’s obviously incredibly meta to crowdfund your crowdfunding platform”, said Salzburg. He explained that the primary goal for the funds they raise will be to develop new features. While they’ve not announced any of these features yet, they plan to take a leaf out of successful campaigns on their platform and reveal their plans over the course of their campaign.

The idea of equity crowdfunding is relatively new — it was signed into law by the Obama administration in 2012. In many ways, it’s a radical change to how startups are supposed to traditionally raise capital. BackerKit is a private company – it has not launched an Initial Public Offering (IPO) or been publicly listed on any stock exchange. Private companies, by definition, have not solicited capital from the public. They might have private investors, but it’s usually a small number. Equity crowdfunding allows startups to raise money from the public – typically, their customers — before they reach the size that listing on a stock exchange would be possible or advisable.

BackerKit will crowdfund equity through a company called WeFunder, who describe themselves as “Robinhood for pre-IPO startups.” According to their website, WeFunder has raised more than $500m for thousands of companies, many of which have gone on to raise funds in more traditional ways. Part of WeFunder’s explicit sales pitch is structuring the capital investment in such a way that potential future venture capital investors are not turned off by the idea of dealing with thousands of existing investors. Salzburg doesn’t rule out approaching venture capital firms in the future, but he mentions that if the current campaign is successful, they could also do another round of equity crowdfunding. “The rules for equity crowdfunding is you can raise up to $5m a year. So you could do it again and again, if you so desired”, he said.

Investors in the campaign don’t receive equity shares in the company but rather subscribe to an SPV or Special Purpose Vehicle that invests in the company on their behalf. Normally, in such a transaction, there’s no guarantee of returns and no liquidity, i.e., the investment is locked until certain criteria is met. According to WeFunder’s website, investors should expect six to seven years to see a return, if they ever do. It is possible that the criteria for recovering their investment is never met.

Given the risk, BackerKit have sweetened the deal with an offer for their existing or future customers. Based on how much someone invests, they earn credits that they can set off against fees they would pay for BackerKit’s crowdfunding services. For example, someone investing $25,000 receives $25,000 in credits that they can set off against future fees. But these are rate limited so the credits can’t be spent at once. In this example, $25,000 credits would be limited to 10% of any given bill. So if you’re accruing a bill of $10,000, you can only set off $1,000 with credits. If you wracked up a $250,000 bill, then you could set off the whole $25,000 in one shot. This offer could make investment much more interesting to publishers and companies such as Brandon Sanderson’s Dragonsteel Entertainment, who could theoretically make their entire money back just through discounts on a few campaigns.

One unexpected problem is the recent revelation that Sahil Lavingia, founder of digital commerce company Gumroad, worked at DOGE under Elon Musk. Lavingia is the lead investor for this WeFunder campaign. Unlike regular equity shareholders, everyone who invests through WeFunder doesn’t receive voting rights and are instead represented by the lead, i.e., Lavingia, who is supposed to act on their behalf. Lavingia’s revelation came in the form of a blogpost titled DOGE Days Are Over where he tries to make it clear that he campaigned for Bernie Sanders in 2016 and only signed up to work for DOGE to solve problems for the government. But he didn’t end up “improving the UX of veterans’ filing disability claims or automating/speeding up claims processing” as he wished. All he really managed to do was help in the firing of thousands of employees from the Department of Veteran Affairs. At best, this makes Lavingia a textbook case of a “useful idiot.”

When asked about whether they knew about Lavingia’s employment with the Trump administration beforehand, Backerkit made the following statement: “Sahil’s investment in BackerKit came before his involvement with DOGE. He has no operational role at BackerKit and no involvement in decisions that affect our team, platform, or the creators we serve. BackerKit’s direction is set entirely by our leadership and grounded in the values we’ve stood by from the beginning. Our focus remains on building trusted tools for creators – a mission we look forward to continuing.”

Salzburg also admitted that the general timing of BackerKit’s equity crowdfunding wasn’t ideal but claimed it wasn’t a direct response to the current market. “We’ve been planning this for six months or something,” he said. “And it certainly wasn’t amazing that our go-day is at a time that was very stressful for creators.” Rascal has previously reported on the apocalyptic nature of Trump’s recent tariffs on various aspects of the tabletop industry. Whether the situation is dire or simply bad changes week to week with the wind and the fickle whims of the White House. “It’s hard to know what is going to happen as a result of this slowdown. And… certainly when the tariffs were 145%, it’s effectively an embargo. It’s not good for anybody’s business. It helped zero people basically, probably just hurt people.”

This situation also directly affects BackerKit as the tabletop industry is one of their biggest markets. Any significant decrease in the industry’s revenue directly affects the company’s bottom line. But Salzburg isn’t gloomy about the future and compares the situation to 2020. “The only reasonable parallel we had is COVID, which was a different situation… There was a big period of uncertainty and then a big collective inhale where no one knew what was going to happen. And then people sort of found a lane and did it. And obviously tabletop games super benefited, right? It was kind of paused and then it’s all 3x growth afterwards. Part of that is everyone was locked at home. Tabletop games are a great way to keep yourself engaged. Not saying that definitively will happen, but I do think I will always bet on creators wanting to create.”