CMON announces layoffs, pauses future game development and new crowdfunding due to US tariffs

Board game crowdfunding giant CMON is laying off staff and halting new game development and campaign launches, citing the ongoing unpredictability in US tariffs.

CMON said it was reducing staff across all of its creative teams due to the current global economic uncertainty, most notably the 145% tariff on China imposed by US president Donald Trump – a situation which has left companies across the board game industry reeling.

The company added that it had paused all future game development and new crowdfunding campaigns “until trade conditions have stabilized”.

CMON currently has 10 yet-to-deliver crowdfunding projects, which raised more than $22m, in various stages of production, with the $3.8m Zombicide: White Death the next game due to reach backers in Q2 of this year.

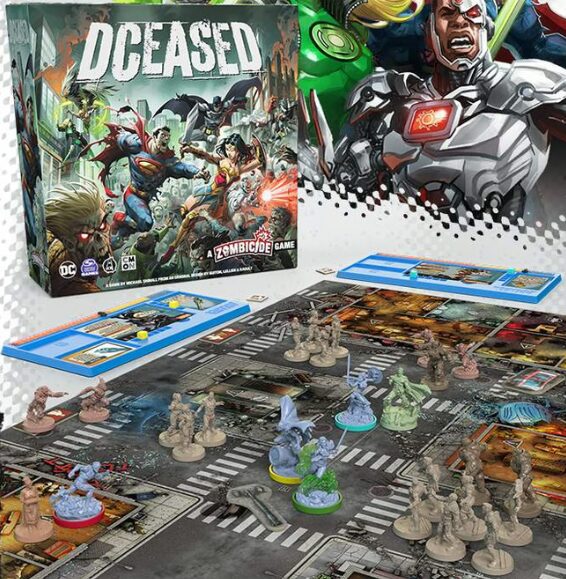

Another seven titles are currently due for delivery later in 2025, including DC Super Heroes United, which raised more than $4.4m on Gamefound, and DCeased: A Zombicide Game, which raised more than $2.5m in a Kickstarter campaign.

CMON also has seven more titles outstanding that were made available through pre-order – five of which are currently slated for Q2 delivery.

Those games headed for the USA are now subject to a 145% import tax based on the manufactured cost of the products – a huge extra cost which was not on the radar of any crowdfunding projects before October last year, when then-presidential candidate Donald Trump starting talking about a 60% tariff on Chinese goods if he was elected to office.

The vast majority of board games are manufactured in China before being shipped around the world, which has left publishers large and small facing situations ranging from a serious financial headache to an existential threat to their business under the new tariff regime.

Last week Jamey Stegmaier, the co-founder and CEO of Wingspan publisher Stonemaier Games, revealed his company was facing an upcoming $1.5m bill under the new tariff regime for its games due to enter the US.

Stegmaier added that his company had now joined a lawsuit challenging Trump’s assertion that he can issue tariffs without oversight or accountability from lawmakers in the US Congress.

A statement from CMON about the layoffs, which it described as “extremely difficult staffing decisions”, said, “We did not make this choice lightly, and our thoughts are with everyone impacted.

“We are incredibly grateful for their roles in our success over the years, and these talented people will be missed both professionally and personally.

“The industry continues to rapidly evolve, and unpredictable situations like the recent tariffs, or COVID just a few years ago, present challenges for everyone in board games.

“With that said, it is our responsibility to take these difficult measures to ensure that we can keep current projects on track and deliver them in a timely manner. We will of course resume new development as soon as possible.

“Please rest assured that these decisions will help ensure that we keep our commitments to our backers, partners, and community.”

CMON had 87 employees at the beginning of 2024 according to its most recent annual report, up from 78 at the start of the previous year.

It said its total staff cost for 2023 was around $4m, about $945,000 of which went to its eight executive and non-executive directors. Company co-CEO Ng Chern Ann received just over $249,500 that year, while fellow co-CEO David Doust received about $240,000.

CMON has been at the forefront of the board game crowdfunding boom since raising more than $780,000 for the original Zombicide in 2012.

The company has swelled in size over the last decade, recording revenues of more than $45m in both 2022 and 2023 thanks to the success of multimillion-dollar Kickstarter campaigns for miniatures-heavy board games, including new Zombicide titles and games based on huge IPs such as Marvel and DC.

But the newly-announced layoffs and halting of new game development continues a troubled start to 2025 for the company, which warned last month that it could face losses of more than $2m for 2024.

A loss of that scale would completely wipe out CMON’s $1.68m profits across the previous three years combined – bringing to an end several years of improving performance as the company recovered from losses of almost $5m in 2020 due to the Covid-19 pandemic.

CMON’s problems were compounded two weeks after the profit warning, when it revealed it was likely to miss its stock exchange deadline for publishing its annual financial results, saying its finance department was understaffed.

CMON is still yet to publish the annual report, which was due before the end of March, and has had its shares suspended from trading on the Hong Kong Stock Exchange.

The company has since announced that it plans to hold a board meeting on April 30 to approve and publish the annual results.

CMON also had to scrap a deal to sell $12m of unspecified IP earlier this year, and revealed that it was taking legal advice after two new shareholders, who were due to invest about $1.39m into the business, had failed to hand over the money for their stakes.

And earlier this month CMON’s long-serving senior manager David Preti resigned as a non-executive director of the company with immediate effect, citing “other work commitments”.

Preti’s decision came seven months after he announced he was resigning as Chief Operating Officer at the company, which he joined as creative director in 2016.

So far this year the company has completed a $2.85m crowdfund for Massive Darkness: Dungeons of Shadowreach on Gamefound, picking up support from more than 9,800 backers.

Last September BoardGameWire reported that CMON‘s mid-year revenue had fallen for the first time since the pandemic, to just over $15.9m, with slumping wholesale earnings putting a dent into the company’s H1 results.

CMON’s wholesale revenue sank 39% to $5.9m in H1 2024 compared to the same period in 2023, while revenue from its crowdfunding campaigns fell by about 9.7% to just over $9.9m.

The company’s cash reserves have also been diminishing, going from $3.9m at the end of 2022 to $3.1m at the end of 2023, and had fallen again to $1.9m at the halfway point of last year.

Yesterday BoardGameWire reported that online board game retailer Boardlandia had become the latest tabletop-related victim of the skyrocketing US tariffs on Chinese imports, with its owners announcing they have closed down the business.

Other early casualties of the tariff hike have included Spirit Island publisher Greater than Games, with parent company Flat River Group laying off the vast majority of its subsidiary’s staff and suspending new projects.

A few days earlier the president of Trekking the World publisher Underdog Games, Nick Bentley, said the company had laid off almost the entirety of its staff – himself included – saying the owner was “shrinking the company to almost nothing to give it the best chance of keeping the lights on during the tariff tsunami”.

Last week Merchants Cove and Coloma publisher Final Frontier Games revealed it was shutting down with three crowdfunding projects worth nearly $1.4m still unfulfilled, claiming that CMON failing to pay for an agreed Chinese localisation of one title was the “final nail” in its coffin.

Come on now, none of these companies that have recently closed are doing it because of tariffs.

Companies that have product on the water have a legit concern and serious unexpected costs if this is still in place when that product reaches port. Not discounting that yet…

CMON had too many project started and not enough delivered (putting them dangerously close to Mythic territory) for a while now. They announced a financial problem well before the tariffs went into place.

No way in heck GTG or Final Frontier were fine until the tariff hit. You don’t get to shutdown position like they did without have lots of other issues.

If they continue the tariffs will be a problem for the industry but let’s not blame them for things that were a long time coming because of poor business operations. Could it be the final straw that makes them decide not to persist into the future… maybe… but not the root cause yet.

So the tarrifs are to blame for CMON’s past? What really happened is they over-promised on campaigns. Then they used the money from the next campaign to try to pay for the previous campaign….It snowballed and they ended up where they are because of poor business. I would be surprised if even 5 of the 10 outstanding campaigns get fulfilled.

[…] heavy loss continues a painful 2025 for the company, which last week revealed it was laying off staff and halting new game development and campaign launches, citing the ongoing unpredictability in US […]

[…] casualties of the volatility have included crowdfunded board game major CMON, which announced it was laying off staff and halting new game development and campaign launches, and Spirit Island publisher Greater than Games, with parent company Flat River Group laying off […]

[…] year – almost double its total profits from the previous three years combined – and has halted new game development and campaign launches amid unpredictability around the US tariffs […]

[…] has been scrambling to stem growing losses since the start of this year, laying off staff and halting new game development and campaign launches in March, and selling off a string of its biggest […]

[…] Board game crowdfunding major CMON, which was already foundering under a severe revenue slump, engaged in mass layoffs and halted new game development around the time the April tariff war began. […]