Acquisitions are back at Asmodee as board game giant eyes more than 20 buyout targets

Tabletop gaming giant Asmodee is preparing to “reignite” its strategy of buying up smaller board game publishers and distributors following its upcoming split from troubled owner Embracer Group.

New CEO Thomas Koegler said the company has a pipeline of more than 20 acquisition opportunities, mirroring the heavy expansion the business undertook after being bought by private equity firm Eurazeo in 2014.

Asmodee’s previous buying spree saw it acquire more than 40 companies and IPs over the last decade, including over 20 game studios including Days of Wonder, Fantasy Flight Games, Lookout Games, Catan Studio and Z-Man Games.

Those buyouts saw Asmodee swell from a specialist French operation to a global heavyweight across publishing and distribution, and led to the business itself being bought out by video games major Embracer Group in a €2.75bn deal in 2021.

Asmodee’s acquisition spree came to an end last summer after Embracer’s planned $2bn partnership deal with Saudi Arabia-based Savvy Games Group fell through, leaving the parent company struggling under a $1.45bn debt pile.

But that acquisition strategy is returning as Asmodee prepares to spin off from Embracer as an independent company, a process due to take place by the end of March next year.

Koegler told investors, analysts, and media at Asmodee’s Capital Markets Day presentation on November 19 that its new acquisition targets were “companies that we know in and out”.

He said, “They are most of them business partners of ours on a daily basis, spread through publishing and distribution capabilities, mainly on the publishing side – and we are quite excited to reignite our second growth engine through acquisitions.”

While Koegler said he could not name specific businesses, the presentation pointed to publishers of the best-selling games Asmodee already distributes in particular regions, as well as social and party game studios and IPs in Europe and the US, and miniature and hobby player games and teams – the latter of which would “increase Asmodee’s reach into the heart of its highest recurring buyer player segment”.

It added that the company was also looking at buyouts of local distribution players to open new geographies, or strengthen its position in countries where it is already present.

Koegler also highlighted the huge opportunity for acquisitions created by board gaming’s highly fragmented market, with the report flagging that there are about 470 separate companies in the US market, 460 in France, 320 in Germany and 170 in the UK alone.

Diminishing Debt

A return to acquisitions initially seemed unlikely for Asmodee when its separation was announced in April, after Embracer loaded the board game maker up with €900m of debt in order to pay down borrowing across the rest of its operations – which includes a suite of PC game studios and licensing the worldwide rights to the Lord of the Rings and The Hobbit.

That debt pile was slashed earlier this week, however, after Embracer announced it was investing €400m in Asmodee, using proceeds from its $1.2bn sale of mobile game developer Easybrain last week.

Asmodee is expected to use €300m to repay debt, with the remaining €100m going towards strengthening its balance sheet ahead of its separation – and to “allow it to resume its value accretive M&A strategy”.

The move brought Asmodee’s leverage ratio down from 3.9x its earnings to a much more stable 2.2x, with the company looking to reduce that to below 2x “in the long term”.

Koegler said of the debt reduction, “Asmodee is well-positioned for the future and we are now setting financial targets to reflect our confidence in our growth trajectory.

“Our aim is to achieve mid-single-digit organic revenue growth over the medium term and an adjusted EBITDA margin in excess of 18% in the medium term.”

Global Board Game Market Still Growing

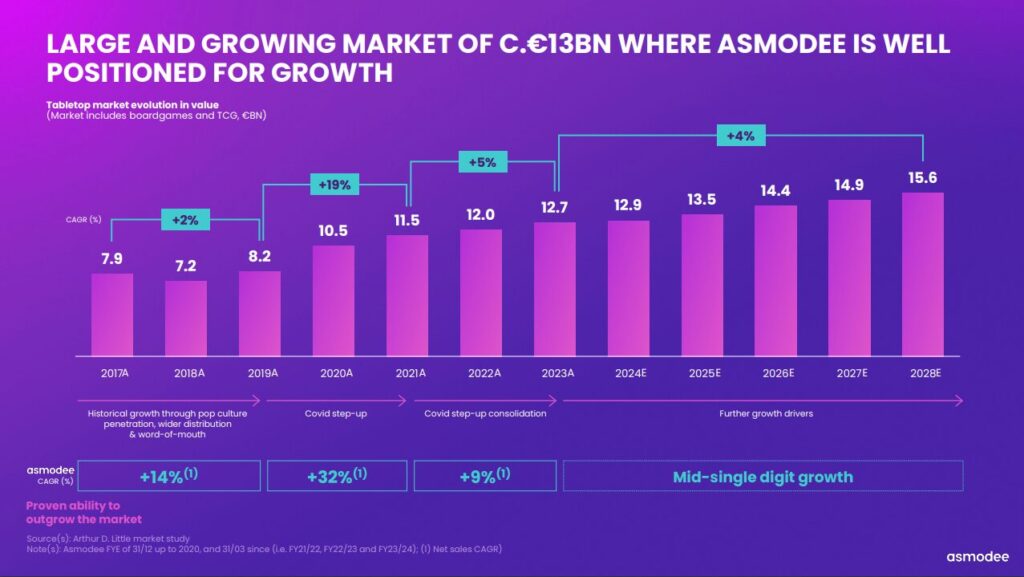

That confidence is underpinned by the ongoing growth of the global tabletop gaming market, which research conducted by Asmodee in August currently pegs at about €13bn – almost double its €7.2bn valuation from 2018.

The research, conducted by management consultancy Arthur D Little, forecasts that figure growing to €15.6bn by 2028, at a compound annual growth rate of about 4%.

That is in line with the 3% and 4% CAGR the industry recorded from 2006 to 2011, and 2011 to 2017 respectively, the data shows, and underscores just how consistently strong board game growth has been over the last 18 years.

Board gaming’s CAGR surged to 19% between 2019 and 2021 as Covid lockdowns saw growing numbers of people buying games to play in their homes.

But even that figure is dwarfed by Asmodee’s own CAGR for the two years, which reached 32%, and was still running at 9% as the market cooled between 2021 and 2023.

The report added that North American and Europe make up 75% of the world’s tabletop market – with 60% of the overall total coming from just four countries.

The US market was pegged at €4.8bn by Arthur D Little, followed by Germany on €1.2bn, France on €1bn and the UK on €0.8bn.

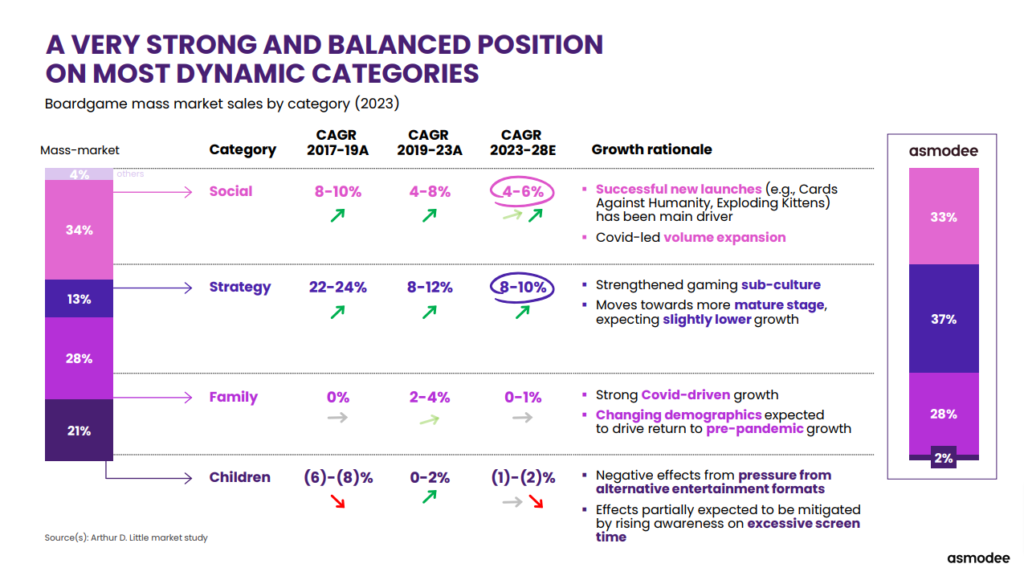

Simon Vivien, the Chief Company Programs Officer at Asmodee, noted during the Capital Markets presentation that hobby gamers only make up between 5% and 10% of the overall game playing audience, with between 50% and 60% of players focused on family weight games such as Ticket to Ride.

But while the CAGR for family games was largely flat between in the two years before the pandemic, more complex hobby games grew between 22% and 24%, and have the highest projected CAGR to 2028, the report shows.

Koegler, who became the company’s first new CEO in 12 years in September, added that he wanted Asmodee itself to become a “renowned brand” with consumers rather than just a corporate home for its studios.

He said, “It’s a project that’s very dear to my heart. Until now Asmodee has remained a corporate, B2B brand. It’s time to make it a consumer facing brand, comlementary to our fan-beloved products and studio brands.

“But having Asmodee as a strong consumer brand will serve as a seal of quality, improve recommendation across products, across studio brands, across play types… leading to more sales.”

[…] Dans sa brève, le journaliste Mike Didymus souligne que cette boulimie d’achat reflète trait pour trait l’activité de l’entreprise avant Embracer, qui l’avait vu acquérir près de 40 entreprises et propriétés intellectuelles. […]

[…] strong year for the board game industry, which has now grown to about €13bn, nears its end, with all eyes turning to the opportunities and challenges presented by 2025. In […]

[…] Three board game publishers BoardGameWire spoke with on condition of anonymity expressed surprise that Asmodee had not been named as a bidder for Alliance, given the tabletop gaming giant’s announcement in November that it was preparing to “reignit…. […]

[…] global business is currently preparing to “reignite” its strategy of buying up smaller board game publishers and…, as it readies itself for its upcoming split from troubled owner Embracer […]

[…] BoardGameWire reported late last year that Asmodee’s impending spin-off from Embracer will be accompanied by the business “reigniting” its strategy of buying up smaller board gam…. […]

[…] has already revealed that it plans to “reignite” its strategy of buying up smaller board game publishers and distributors in the wake of its split from Embracer Group, with eyes on a pipeline of more than 20 acquisitions […]

[…] company had picked out a pipeline of more than 20 acquisition targets, similar to the decade-long spree which saw it buy up studios including Days of Wonder, Fantasy […]

[…] company has picked out a pipeline of more than 20 acquisition targets, similar to the decade-long spree which saw it buy up studios including Days of Wonder, Fantasy […]

[…] the element of the deal that did catch many off guard was the buyer: not Asmodee, despite the company having reignited the acquisitions strategy that saw it swell from a specialist French operation to a global heavyweight across publishing and […]

[…] described his company as “like a Tiny Epic Asmodee”, referencing the huge acquisitions spree Asmodee undertook in the 2010s that turned it from a specialist French operation to a global board game industry […]

[…] company had picked out a pipeline of more than 20 acquisition targets, similar to the decade-long spree which saw it buy up studios including Days of Wonder, Fantasy […]

[…] its growth plans in the wake of its split from its former owner Embracer Group earlier this year would include “reigniting” its strategy of buying up smaller board game publishers and d…, mirroring the explosive growth the company undertook after being bought by private equity firm […]