Retailers step in to help Dutch publisher Splotter after US distributor GTS cancels ‘large order’ over tariff uncertainty

Food Chain Magnate publisher Splotter Spellen says US distribution major GTS has cancelled a “large order” for its game Indonesia at short notice, citing uncertainty over further changes to import tariffs in the country.

US President Donald Trump hiked tariffs on imports from China – where the vast majority of board games are manufactured – by 10% at the start of February, and last November threatened Chinese goods with 80% tariffs, in addition to a blanket 20% on all imports to the US.

China has responded with tit-for-tat tariff increases for several types of US product, and Trump’s subsequent threats of further hikes for sectors such as automobiles has created huge unpredictability about how much further US tariffs could rise.

Splotter, a small Dutch publisher run by design duo Jeroen Doumen and Joris Wiersinga, said on February 17 that almost all the US retailers who offered pre-orders for the third edition of Indonesia were being supplied through GTS, meaning US customers expecting the game would now not receive their copy.

Doumen and Wiersinga provided an update yesterday to say that a string of US and Canadian retailers had since been in touch attempting to help by securing direct orders, while other distributors and publishers had also made contact about the situation.

GameNerdz, Tanuki Games and Cardhaus in the US, and BoardGameBliss and 401 Games in Canada were highlighted by Splotter as having contacted the publisher to arrange direct orders, while Peachstate Hobby Distribution purchasing manager Mike Paschal responded to Splotter on Facebook saying he would “see if we here at PHD can make this right”.

Wiersinga told BoardGameWire those shops account for a little under half of the total order cancelled by GTS.

Patrick Day, director of business development for gaming at GTS, did not reply to BoardGameWire’s questions about the situation, including whether orders from other publishers are likely to be cancelled in a similar way to Splotter’s.

It is unclear at this stage if the cancellation was a cautious, pre-emptive move from GTS itself while the distributor waits for more certainty over future tariff changes, whether it is a knock-on result of retailers in the US cutting back on some of their own orders, or another unknown reason.

GTS has distributed Splotter’s games in the US for the past 13 years. Splotter said of the situation, “We regret that our long time trusted partner GTS felt compelled to take this action. Unpredictable rules can make doing business very difficult.”

Answering questions about the situation via Facebook, Splotter said, “I think a 10% or even a 25% tariff would not stop business – but an unknown tariff does.

“The distributor tries to take pre-orders from shops at a given price before committing to us – now they have to ask shops (and ultimately, customers) for a commitment for a fixed price + unknown tariff and that is not yet something they can do.”

Wiersinga added in a BoardGameGeek post, “The big issue here is uncertainty, not the absolute size of the tariff. Being unpredictable can be great as a negotiation strategy but it is killing for business.”

Speaking Out

Responding to criticism on a BoardGameGeek thread that Splotter should not have publicised the issue or mentioned GTS until it had spent more time looking into alternatives, Wiersinga said, “We wanted to convey the issue loud and clear so people have an option to find another solution or accept they will not get the game.

“We normally prioritize Dutch clarity over friendly statements of intent that are likely not going to be followed through. This, for sure, is a cultural difference. But we would also be the ones who would potentially get over 1,000 emails from people complaining we did not warn them in time if we informed people insufficiently.

“We could indeed have chosen to omit the exact sequence of events and kept our distributor out of this discussion. We have tried to express our understanding of what drove their decision and our appreciation of them as a long-time partner.

“Still, we think it is good to make clear that neither Splotter nor the shops made this call. The fact that we were informed very late of this change is one of the reasons it is hard for us to find alternatives. We are taking a pretty big financial hit (intercultural note: Dutch love to use understatement when talking about themselves).

“I saw some suggestions that we are unhappy with past GTS behaviour – we are not unhappy at all. They have been a key actor bringing our games to the US since 2012, they were the ones convincing us to do reprints of old titles and they initially financed this with pre-payments, and they were the ones making Food Chain a commercial success for us.”

Doumen and Wiersinga said in their original announcement, “Given the cancelled order, we will probably print a lot fewer games than we planned originally.

“This means that even if things calm down, we won’t have stock to supply US shops later in the year. We will also not halt production to find a better solution to supply shops – all those who have pre-ordered have waited more than long enough for their games.”

Splotter, which was launched in 1997, has carved out a successful niche within the board game industry by specialising in deeply-strategic, complicated and often unforgiving designs.

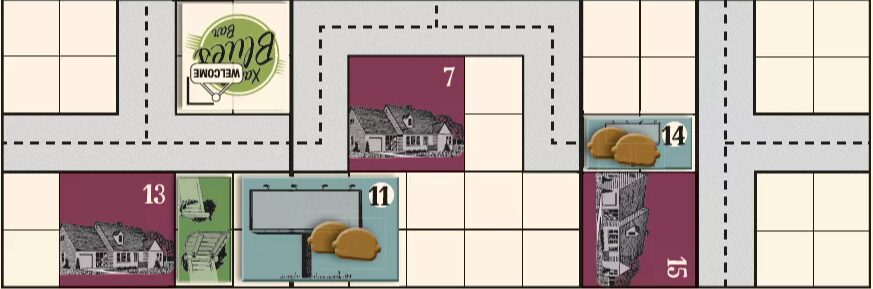

The company made a name for itself with games such as Bus and Roads & Boats, before striking it big with 1950s-themed fast food chain delivery game Food Chain Magnate in 2015.

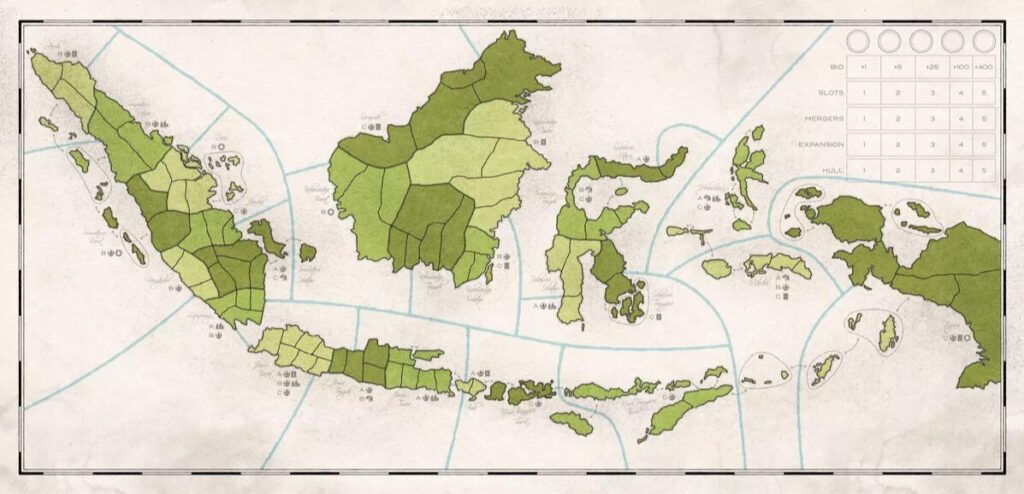

Indonesia, a game about producing and shipping goods such as rice, spices, microwaves and rubber in the country, was first released in 2005, and received a second edition in 2016. It is the second-highest rated Splotter game on BoardGameGeek after Food Chain Magnate.

A special edition of Food Chain Magnate featuring deluxe components raised more than €2m through a Gamefound crowdfunding campaign from Lucky Duck Games at the end of 2023.

[…] but ongoing sabre-rattling from Trump and tit-for-tat tariffs on US goods introduced by China have created an unpredictable trading environment. In this article for BoardGameWire, Robert Geistlinger, president of US board game major Arcane […]

[…] Sin embargo, encontramos otra noticia unos pocos días después:https://boardgamewire.com/index.php/2025/02/20/retailers-step-in-to-help-dutch-publisher-splotter-af… […]