Board game publishers brace for shipping price hike, delays as US drops tariffs on China to 30% in 90-day ‘truce’

Elevated tariffs continue to threaten the board game industry despite a 90-day ‘truce’ between the US and China – with publishers now facing a spike in shipping prices and a battle for limited container space as businesses race to take advantage of the lower-tariff window.

Board game publishers had already warned of inevitable prices increases back in February, when newly-inaugurated US President Donald Trump unveiled a 10% tariff on goods being imported from China – where the vast majority of board games are manufactured.

Since then the entire industry – from publishers and manufacturers to retailers, distributors and designers – have been left reeling by the rapidly escalating trade war between the two countries, which saw US tariffs on China reach 145% on April 9.

That figure has now been cut to 30% for a 90-day period from May 14, as China and the US engage in talks to bring the trade war to an end.

But despite Trump describing the pause as a “total reset” in relations with China, the still-elevated 30% tariff rate – and the likely scramble for shipping container space – means the President has “traded one self-inflicted problem for another”, Renegade Game Studios founder Scott Gaeta told BoardGameWire.

He said, “In the short term we will move more product from China. But even though 30% is much better, let’s be clear, we’ve come from a level (145%) that was absurd and devastating. 30% is still problematic but more manageable.

“The disruption caused in the supply chain the last month will now likely lead to importers paying extremely high rates to move that freight as the world rushes to take advantage of this 90-day window. We’ve traded one self-inflicted problem for another.

“Long term planning is still not possible. Now we wait and see what happens in 90 days while trying to salvage Q3 and Q4 as best we can.”

Gaeta’s analysis was echoed by T Caires, a director at Sky Team publisher Hachette Boardgames USA, who told BoardGameWire, “This change doesn’t actually super help us. A 90-day pause is not long enough to let us return to ‘business as usual’.

“A lot of container ships cancelled sailing plans and there’s a large backlog of product in China – like, two months of shipments for every industry – and the boardgame industry does not have the flexibility of income to afford the shipping rates that the larger industries and companies can.

“We’re anticipating this will be like after COVID lockdowns ended and we kept getting our containers bumped off ships by companies that were willing to pay more. We actually had a container that we shipped from China pulled off in South Korea in 2022, for three months, because another company outbid us, apparently, even after we had the freight booked and onboard.”

Judah Levine, head of research at international freight booking major Freightos Group, warned yesterday that shippers were facing rising container prices and likely delays as companies move to get stockpiled products that have been sitting in China during the 145% tariff rate onto the water.

He said, “While the 145% tariffs drove a drop of 35% or more in China-US ocean volumes since early April, we’re likely to see a significant demand rebound in the near term as shippers replenish inventories that may have started to run down in the past month, and as many Chinese manufacturers have high levels of finished goods already ready to ship.

“And with an August deadline for the possible return of higher tariff levels, it is likely we’ll see frontloading restart, meaning an early start and probably an early tapering off of peak season-level volumes this year.

He added, “If demand does pick up sharply, shippers may face a period of tight capacity and some equipment shortages as vessels and containers are moved back into place. A big increase in demand would also mean a big bump in the number of vessels and container volumes arriving at US ports in a few weeks.

“Taken together, shippers could face increased container rates and some congestion and delays in the next few weeks at both origins and US destinations.”

Production headaches

That danger is causing a major headache for publishers, many of whom have long relationships with specific manufacturers, and specific production needs which aren’t easy to quickly swap between component makers.

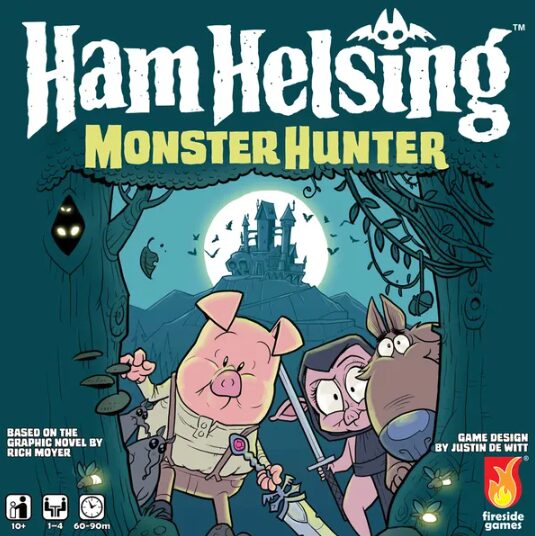

Anne-Marie De Witt, CEO of Castle Panic publisher Fireside Games, told BoardGameWire, “We held printing of our second release for 2025, Ham Helsing, because the components include card sleeves and transparent cards. We don’t trust the manufacturing of those materials to just any printer.

“Last week, we sent out [requests for proposals] to potential printers, and we’re opening up our inbox today to see who replied. We want to move quickly on this game now, just like every other publisher is doing.

“The wild card now is the cost of ocean freight and trucking. With demand high coming out of China, we could see an explosion in rates that make printing in other countries the more affordable option.

“The problem is you can only get quotes a certain time period out. From the time we order the print run to the time we need to load the product on a boat, the rates could change dramatically.

“Depending on the rate, it might be wiser to then hold the product until rates subside – but that introduces another element of uncertainty. When will rates drop? And what does that mean about storage rates and holiday timing?”

John Stacy, the executive director of non-profit trade body The Game Manufacturers Association, told BoardGameWire publishers now face the burden of “scrambling to decide if they want to ship their products now, or wait the three months to see where the potentially ‘final rate’ will be”.

He said, “Many will want to have product for the crucial summer/fall release schedule or Q4 shopping season and will ship those products. They of course will have to figure out how to adjust pricing to reflect the 30% additional cost that didn’t exist when they started production months ago.

“Those that are not as far along in their production schedule will have to determine if they can complete manufacturing and shipping in the next 90 days so they know what their cost will be when it arrives. Any delays or miscalculations can have a devastating impact if the agreed rates are higher than 30%.

“Publishers that cannot make the 90-day window will most likely wait to see how it all shakes out before making any business decisions on new products or games. The uncertainty is just too high to make decisions without enough information.

“Who wants to play a game where the rules change every round and it’s not clear what those rules are until you are halfway through the next round?”

Damage already done

While Trump hailed the 90-day pause in the trade war he began as “great progress” being made, the move has already come too late for a string of now-unemployed staff from companies across the board games spectrum.

Last month crowdfunded board game major CMON announced it was laying off staff and halting new game development and campaign launches, citing the ongoing unpredictability in US tariffs.

Other early casualties of the tariff hike have included Spirit Island publisher Greater than Games, with parent company Flat River Group laying off the vast majority of its subsidiary’s staff and suspending new projects.

Online board game retailer Boardlandia’s owners announced towards the end of April that they had closed down the business, saying the tariffs had added “an unsustainable burden” to their existing financial challenges, while a few days earlier the president of Trekking the World publisher Underdog Games, Nick Bentley, said the company had laid off almost the entirety of its staff – himself included – saying the owner was “shrinking the company to almost nothing to give it the best chance of keeping the lights on during the tariff tsunami”.

Price Johnson, the COO of Gloomhaven publisher Cephalofair Games, has been fighting hard over the past few weeks to raise awareness of the huge problems US tariffs are causing the board game hobby, including high-profile appearances on news outlets such as CNN.

He wrote of the latest tariff shift, “Before we latch too closely on today’s ‘tariff pause’, a reminder that anything over 50% was already having cataclysmic impact on multiple industries of small and medium sized enterprises. Anything over 50%, and certainly 100%, was effectively an embargo that brought China < = > US trade [to] a screeching halt.

“So where are we today? +10% higher than before the effective embargo started over a month ago, and +30% higher than we started this year. And for 90 days, which sure is enough time to get existing product out of China, but severely limits our ability to plan and execute on the rest of this year, assuming rates don’t fall further or worse raise again.

“That’s not a win or a ‘historic deal’. That doesn’t get my praise or thanks. That’s more/less the bare-minimum step to avoid pandemic level trade disruption. Nothing less according to economists and industry experts.

“Our business and industry have in no way been made ‘greater’. You can still expect fewer consumer choices, higher prices, more layoffs/furloughs, and stagnation in domestic innovation, investment, and growth so long as this trade war persists.

“In many cases the damage is already done. What manufacturer is going to invest domestically knowing the can’s been kicked another 90 days?”

Legal action

Jamey Stegmaier, the co-founder of Wingspan publisher Stonemaier Games, has also been outspoken on the danger and damage of the tariffs to hobby gaming – and two weeks ago launched a lawsuit suing the Trump administration over his decision to impose the tariffs “with no oversight or accountability”.

Stegmaier, whose company was facing an unexpected $1.5m bill under the 145% tariffs, told BoardGameWire, “We will absolutely proceed with the lawsuit, which focuses on the constitutional power of Congress to apply taxes (not the President).

“A tax like this has such a massive impact on small US businesses that it deserves the due process that we’re seeking with the lawsuit.”

He added, “A decrease from 145% to 30% is progress, but it still does not take into consideration the need for a grace period for products that were already in production in China before the tariffs existed, including 250,000 units made by Stonemaier Games.

“100,000 of those units were Finspan and Vantage, two products we planned to ship regardless of the tariffs; we’ll proceed to ship 65% of them to the US along with the other units that we were planning to temporarily store in China and/or ship to Canada for temporary storage.

“I’m not sure yet if 30% will impact our US prices, as consumers still need to see the impact of tariffs on the products created by small businesses.”

Others continuing to publicly fight the tariffs include GAMA, which has been lobbying for an exemption for the board game industry and is a supporter of the global Zero Tariffs for Toys initiative.

Executive director John Stacy told BoardGameWire, ” We do not believe that the current administration has the legal authority to implement unilateral tariffs under the emergency powers that they are using to justify the trade war. There are several lawsuits addressing this overreach. We strongly support the suits and look forward to them addressing this issue.

“We have also been engaging with members of Congress and their staff to restore the proper legislative oversight of taxation and trade. We are urging them to support bipartisan legislation that would correct the current course.

“I was in DC several weeks ago with a number of association executives lobby on this issue. GAMA will be returning to DC twice in the coming weeks (June 10 to 11 and June 25) as part of a two coalitions of associations and small businesses group.

“We are recruiting members to join us on these two fly-ins and will arranging contacts with members and key legislators in their home states as well. There is still a lot for us to do on this issue and we will continue advocating on behalf of the tabletop games industry. “

[…] She also plans to show off rhyming word party game Know-It Poet, which had been signed Greater Than Games, but was returned to Leiman after the company was downsized by owner Flat River group last month, in the wake of the US imposing heavy import tariffs on China-made products. […]

[…] https://boardgamewire.com/index.php/2025/05/13/board-game-publishers-brace-for-shipping-price-hike-d… […]

[…] Renegade has recently announced US price increases across its next wave of Heroscape releases and games including Axis & Allies: Stalingrad, Diplomacy, Naishi and Arboretum due to US tariffs on China, which soared as high as 145% last month before a 90-day ‘truce’ was announced in mid-May. […]

[…] Koegler revealed Asmodee’s tariff mitigation strategy so far had included delaying some of its imports to the US, but he added that the company was making the most of the recent 90-day ‘pause’ that saw US tariffs on China set at 30%. […]

[…] growing to roughly 32,000 attendees in 2023, 39,000 in 2024 and over 42,000 this year, despite the current dark cloud of US tariffs forcing several publishers – including big names such as Arcane Wonders – to pull out […]

[…] 90-day truce is now causing its own problems, with tabletop publishers bracing themselves for shipping price hikes and further delivery delays, as companies scramble to get goods onto boats and into the US before the arrangement expires at […]

[…] But the company has been forced into selling its most famous and profitable title after slumping to a $3m loss last year – almost double its total profits from the previous three years combined – and has halted new game development and campaign launches amid unpredictability around the US tariffs situation. […]

[…] Restoration Games, the US board game publisher focused on reviving and rejuvenating classic titles, is benefiting from foresight in staffing up across the last year as the impact of tariffs continues to make itself felt upon the industry. […]

[…] that now might be a dangerous time for a board game publisher to be expanding operations, given that the unpredictability of the US tariffs situation has already seen some publishers shutter operations and let go of […]

[…] booths at Gen Con in August, despite Flat River having cancelled its own presence in the wake of US tariff instability earlier this […]

[…] spokesperson Roger Anthony-Gerroldt told BoardGameWire US tariffs volatility had caused the company to miss its expected 2025 window for getting new games including Popcorn […]

[…] when a new surprise entered play. A large portion of the tariffs had been paused for 90 days! They dropped down from 145% to 30%, and, as of writing this, have stayed stable. It’s still an unfortunate bill, but it’s much […]

[…] Gen Con, has scored another year of record attendance and exhibitor numbers, despite fears that ongoing US tariff volatility would see publishers and visitors choosing to skip the 2025 […]

[…] Advocacy and brand protection is also one of its near-term priorities – underscored by the organisation’s recent intensive lobbying and awareness efforts around the impact on the industry of US tariffs. […]

[…] has also been at the forefront of GAMA’s extensive lobbying and awareness efforts around the impact on the industry of US tariffs, which have included multiple trips to Washington DC to lobby politicians, conducting dozens of […]

[…] That decision comes despite Amigo Games being one of the few hobby board game publishers that managed to diversify some of its manufacturing away from China – one of the countries which has been hit the heaviest by recent US tariffs. […]

[…] small increase comes despite the assumption from Spiel Essen organisers earlier this year that the ongoing impact of US tariffs on board game publishers could see a fall in the number of companies heading across the Atlantic for the 2025 […]

[…] figure was cut to its current rate of 30% in mid-May as the two countries engaged in talks to bring the trade war to an end – but even that […]

[…] laying off staff and halting new game development and campaign launches, citing the ongoing unpredictability around US tariffs, in order to focus on fulfilling its eight undelivered crowdfunding campaigns, which raised […]